Get a comprehensive understanding of who decides crypto prices. Learn about supply and demand, market sentiment, technology, and regulatory impacts.

Cryptocurrencies have captured the attention of investors and the general public alike, with their prices often experiencing significant fluctuations. A common question that arises is: who decides crypto prices? In this article, we will explore the factors that influence cryptocurrency prices and how they are determined.

The Basics of Cryptocurrency Pricing

The role of supply and demand

Supply and demand is a fundamental economic principle that governs the price of goods and services in a market. Similarly, cryptocurrency prices are influenced by the balance between supply (sellers) and demand (buyers). When more people want to buy a particular cryptocurrency than sell it, the price goes up. Conversely, when there are more sellers than buyers, the price goes down.

In a decentralized market like cryptocurrencies, the price is determined by the highest amount a buyer is willing to pay and the lowest amount a seller is willing to accept. As supply and demand shift, so do the equilibrium price points at which buyers and sellers agree to transact.

Cryptocurrency exchanges and price discovery

Cryptocurrency exchanges play a crucial role in determining the price of cryptocurrencies. Exchanges facilitate trading between various cryptocurrencies and fiat currencies, allowing users to buy and sell digital assets. The prices on exchanges are determined by the interaction between buyers and sellers, with the exchange acting as an intermediary.

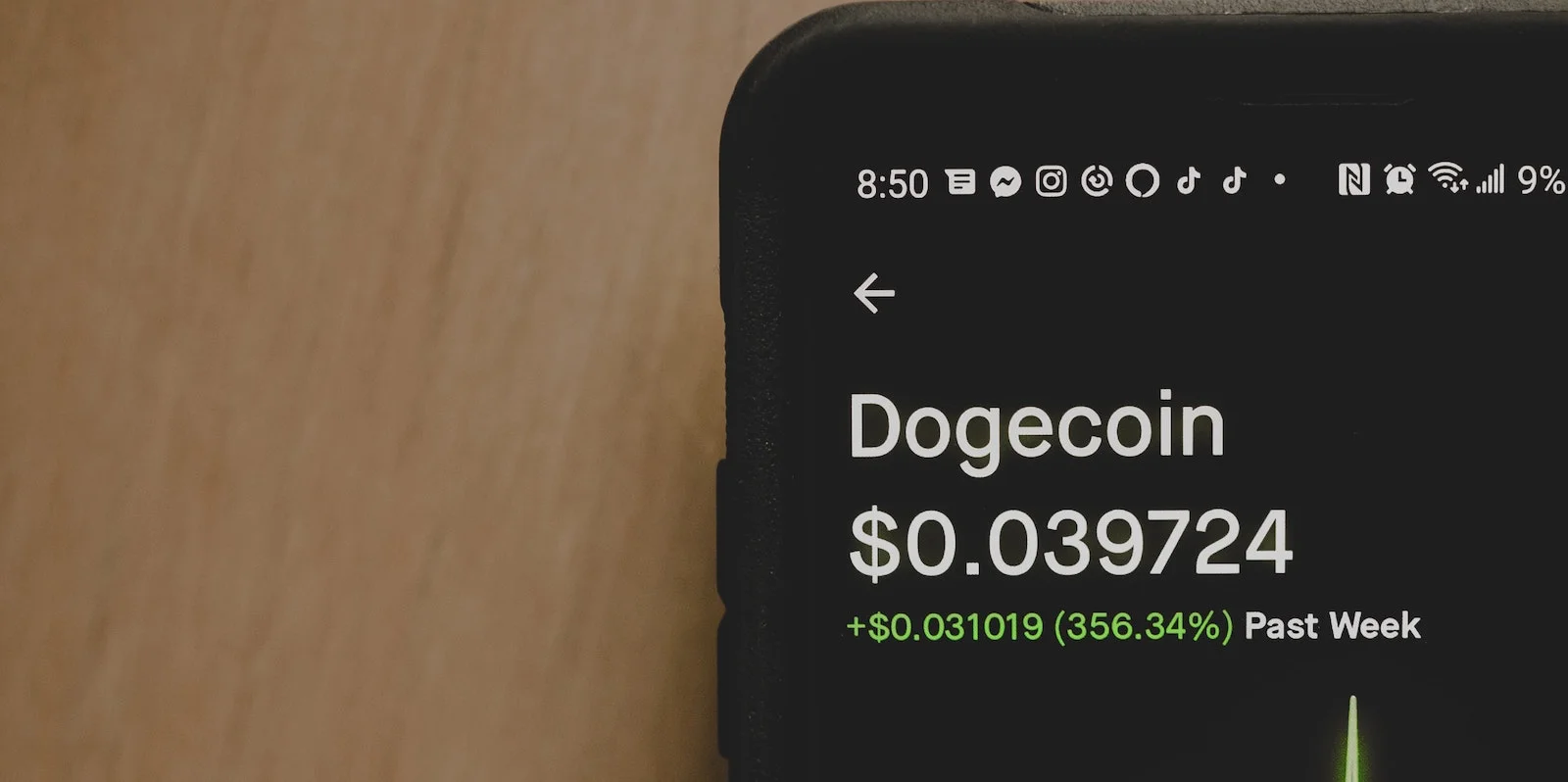

Price discovery is the process through which the market determines the price of an asset. On cryptocurrency exchanges, price discovery occurs through the continuous matching of buy and sell orders. When a buyer’s order matches a seller’s order, a trade is executed, and the price of the transaction is recorded. The most recent trade price then becomes the current market price of the cryptocurrency.

Key Factors Influencing Cryptocurrency Prices

Market sentiment and investor behavior

Market sentiment, or the overall attitude of investors towards a particular asset, plays a significant role in determining cryptocurrency prices. Emotions and investor psychology can drive prices up or down, often leading to market trends that may not necessarily reflect the underlying value of the asset. Fear and greed are two powerful emotions that can significantly influence market sentiment.

Fear can cause investors to panic sell, leading to a drop in prices. Greed, on the other hand, can result in irrational buying, driving prices higher. FOMO, or the fear of missing out, occurs when investors see a rapidly rising market and decide to buy in, hoping to profit from the upward trend. This can create a feedback loop, with rising prices attracting more buyers, further pushing up the price.

Media coverage and public perception

Media coverage plays a significant role in shaping public perception of cryptocurrencies and influencing their prices. Positive news stories about cryptocurrency adoption, technological advancements, or regulatory developments can boost investor confidence and lead to increased demand. Conversely, negative news, such as hacks or regulatory crackdowns, can cause fear and uncertainty, leading to selling pressure and falling prices.

Increased public awareness of cryptocurrencies can lead to higher demand and, consequently, higher prices. As more people learn about the potential benefits of digital assets, they may decide to invest, driving up demand and prices. Conversely, negative public perception or lack of awareness can limit the growth of the market and suppress prices.

Technological advancements and network effects

Technological advancements in the cryptocurrency space can significantly influence prices. For example, improvements in scalability, privacy, or security can make a particular cryptocurrency more attractive to users and investors, leading to increased demand and higher prices.

Network effects refer to the phenomenon where the value of a product or service increases as more people use it. In the context of cryptocurrencies, network effects can drive adoption and, consequently, prices. As more people join a cryptocurrency network, the value of the network increases, attracting even more users and further boosting the price.

Regulatory environment and government actions

The regulatory environment surrounding cryptocurrencies can have a significant influence on their prices. Favorable regulations, such as clear legal frameworks and supportive government policies, can promote adoption and increase demand, driving up prices. Conversely, restrictive regulations, bans, or unfavorable government actions can create uncertainty and fear, leading to selling pressure and lower prices.

Regulatory uncertainty can have a negative impact on cryptocurrency prices. When the regulatory environment is unclear or subject to sudden changes, investors may become hesitant to enter the market or decide to sell their holdings, leading to lower demand and falling prices.

Market manipulation and whales

Market manipulation refers to the act of artificially influencing the price of an asset for personal gain. In the cryptocurrency market, manipulation can take various forms, such as pump-and-dump schemes, wash trading, or spoofing. Such activities can distort prices and create false signals, making it difficult for investors to accurately assess the true value of a cryptocurrency.

Large holders of cryptocurrencies, often referred to as “whales,” can significantly influence prices due to their ability to move the market with large buy or sell orders. Whales can create significant price swings, either intentionally or unintentionally, by placing large orders that can cause other market participants to react.

The Role of Market Capitalization and Trading Volume

Market capitalization and its significance

Market capitalization is the total value of all outstanding units of a cryptocurrency, calculated by multiplying the current market price by the total circulating supply. Market capitalization is often used as a metric for evaluating the size and relative importance of a cryptocurrency within the market. A higher market capitalization generally indicates a more valuable and widely adopted cryptocurrency.

While market capitalization is a useful metric for comparing cryptocurrencies, it has its limitations. For example, it does not account for differences in utility, technology, or the strength of the underlying network. Additionally, market capitalization can be distorted by factors such as token distribution, market manipulation, or low trading volumes.

Trading volume and liquidity

Trading volume is the total amount of a cryptocurrency that is bought and sold over a specific period, typically measured in 24-hour intervals. Trading volume can provide insights into the liquidity, popularity, and stability of a cryptocurrency. Higher trading volumes generally indicate a more liquid and active market, which can result in more accurate price discovery and lower price volatility.

Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. In the context of cryptocurrencies, higher trading volumes are often associated with higher liquidity. When a market is more liquid, it can absorb larger buy and sell orders without causing significant price swings. This can result in greater price stability, making the cryptocurrency more attractive to both investors and users.

Conclusion

In summary, who decides crypto prices is not a simple question to answer. Cryptocurrency prices are influenced by a complex interplay of factors, including supply and demand, market sentiment, media coverage, technological advancements, regulatory environment, and market manipulation, among others. Understanding these factors and the role they play in determining prices is crucial for anyone interested in investing in or using cryptocurrencies.