Get a deep understanding of what is APR in DeFi with our comprehensive guide. Learn its significance, factors affecting it, and how to calculate it for optimal returns.

APR, or Annual Percentage Rate, is a familiar term in traditional finance. However, as the world of decentralized finance (DeFi) continues to grow, it’s essential to understand what is APR in DeFi and how it impacts your investments. In this guide, we will explore the basics of APR, how it functions within the DeFi ecosystem, and its significance for investors.

What is APR – Definition

The Annual Percentage Rate (APR) is a percentage that represents the annual cost of borrowing or the return on an investment. In traditional finance, APR is used to calculate interest rates on loans, credit cards, and other financial products. It includes fees, interest rates, and other charges, providing a more accurate representation of the total cost of borrowing.

What is APR in DeFi?

In the world of decentralized finance, APR serves a similar purpose as in traditional finance. APR in DeFi primarily relates to the annualized return on investment for various activities, such as lending, staking, or liquidity provision. The APR can be a crucial factor for investors to consider when deciding which DeFi platforms to participate in, as it helps them evaluate potential returns on their investments.

APR in DeFi Lending Platforms

DeFi lending platforms enable users to lend or borrow digital assets, such as cryptocurrencies. By depositing their assets, lenders earn interest in the form of APR. The lending platform calculates the APR based on the demand for borrowing and the available supply of the digital asset.

APR in DeFi Staking

Staking is the process of participating in the proof-of-stake (PoS) consensus mechanism of a blockchain network by locking up your tokens. In return for staking, users receive rewards in the form of newly minted tokens, which can be expressed as an APR.

APR in DeFi Liquidity Pools

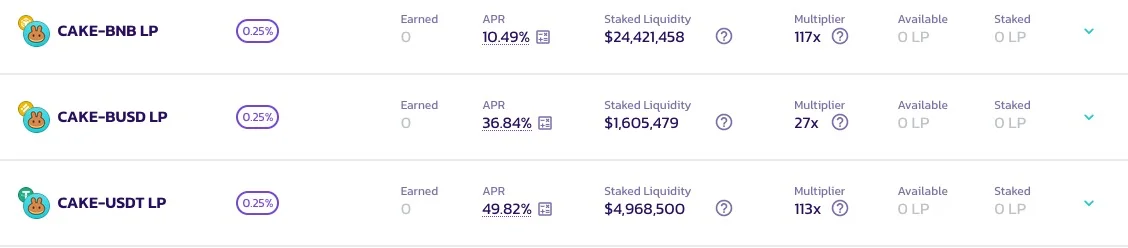

Liquidity pools are a core feature of decentralized exchanges (DEXes) and other DeFi applications. Users can contribute their assets to these pools and become liquidity providers (LPs). In return for providing liquidity, LPs earn a portion of the trading fees generated by the platform, which can be calculated as an APR.

Factors Influencing APR in DeFi

Several factors can impact what is APR in DeFi, including:

- Supply and demand: The balance between the supply of and demand for assets in a lending platform or liquidity pool can affect the APR. Higher demand for borrowing or trading typically leads to higher APRs.

- Platform fees: DeFi platforms may charge various fees, such as transaction fees or withdrawal fees. These fees can impact the APR and should be considered when calculating potential returns.

- Impermanent loss: In DeFi liquidity pools, impermanent loss can occur when the value of the assets in the pool fluctuates. This can impact the overall APR for liquidity providers.

- Token price volatility: The volatility of the underlying digital assets can influence the APR in DeFi, as changes in asset prices can affect the returns on investment.

How to Calculate APR in DeFi

To calculate the APR in DeFi, you can use the following formula:

APR = (Total Return / Initial Investment) * (365 / Investment Duration)

This formula takes into account the total return on investment, the initial investment amount, and the duration of the investment in days.

Conclusion

Understanding what is APR in DeFi is crucial for investors looking to participate in the growing DeFi ecosystem. APR can help you make informed decisions about which platforms to invest in and how to manage your portfolio. Always consider factors such as supply and demand, platform fees, impermanent loss, and token price volatility when evaluating potential returns. By carefully considering these factors and calculating the APR, you can maximize your earnings and mitigate risks in the world of decentralized finance.