Demystify how are cryptocurrency prices determined by diving into market dynamics, regulatory influences, adoption trends, and the role of market sentiment.

Cryptocurrencies have revolutionized the financial landscape, providing a new means of conducting transactions and storing value. With the increasing popularity and market capitalization of these digital assets, understanding how are cryptocurrency prices determined has become more important than ever. In this article, we’ll explore the factors that influence cryptocurrency prices and the dynamics that drive the market.

Supply and Demand: The Heart of Cryptocurrency Valuations

The primary factor in determining cryptocurrency prices is supply and demand. Like traditional assets, the value of cryptocurrencies is directly influenced by how many people want to buy them and how many are willing to sell. As demand for a cryptocurrency increases, so does its price, and vice versa.

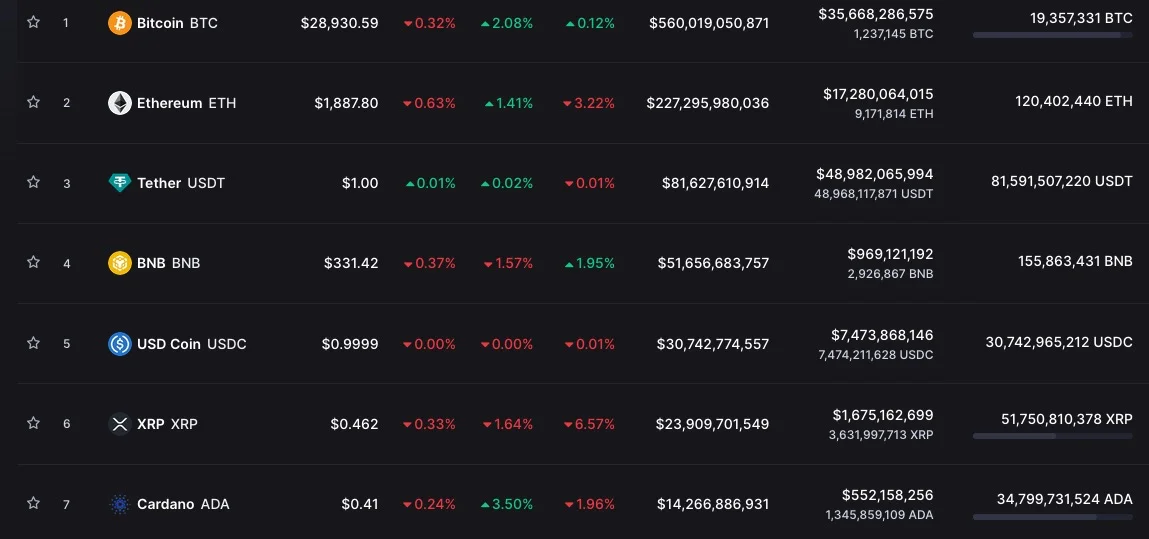

Market Capitalization

Market capitalization, or market cap, plays a significant role in determining cryptocurrency prices. It is calculated by multiplying the current price of a cryptocurrency by its circulating supply. A higher market cap indicates a more valuable cryptocurrency, and investors often use this metric to compare the relative size and value of different cryptocurrencies.

Circulating Supply

The circulating supply of a cryptocurrency is the number of coins or tokens that are available for trading in the market. This supply can change over time due to factors such as mining, staking, and burning of coins. A lower circulating supply can lead to higher prices, as there are fewer coins available for trading, while a higher supply can lead to lower prices.

Intrinsic and Extrinsic Factors Affecting Cryptocurrency Prices

Several intrinsic and extrinsic factors can influence how are cryptocurrency prices determined. These factors can range from market sentiment to regulatory changes, and understanding them can help investors make informed decisions about their investments.

Technological Developments

Advancements in technology can have a direct impact on cryptocurrency prices. For example, improvements in blockchain technology, such as increased transaction speeds or enhanced security features, can increase the perceived value of a cryptocurrency, driving up its price. Conversely, security breaches or technological limitations can negatively affect a cryptocurrency’s price.

Market Sentiment

Market sentiment, or the overall attitude of investors towards a particular cryptocurrency, is another key factor in determining prices. Positive sentiment, driven by factors such as favorable news, can lead to increased demand and higher prices. On the other hand, negative sentiment, fueled by events like unfavorable regulatory changes or high-profile hacks, can lead to decreased demand and lower prices.

Regulatory Environment

The regulatory environment can have a significant impact on cryptocurrency prices. Governments around the world are grappling with how to regulate these digital assets, and their decisions can affect the overall market. For example, regulatory approval of cryptocurrency-based financial products, such as ETFs, can boost prices, while regulatory crackdowns or bans can lead to price declines.

Adoption and Use Cases

As more people and businesses adopt cryptocurrencies for various use cases, their demand and value tend to increase. Widespread adoption of a cryptocurrency as a means of payment, for example, can drive up its price. Conversely, limited adoption or lack of practical use cases can negatively affect a cryptocurrency’s value.

Price Manipulation and Volatility

One aspect of how are cryptocurrency prices determined is the potential for price manipulation and volatility. Due to the relatively small size of the cryptocurrency market compared to traditional financial markets, it can be more susceptible to price manipulation by large players, known as “whales.”

Furthermore, the cryptocurrency market is known for its volatility, with prices often experiencing significant fluctuations within short periods. This volatility can be driven by factors such as market sentiment, news events, and trading volume, and can make it challenging for investors to predict future prices.

Conclusion

Understanding how are cryptocurrency prices determined is crucial for investors and enthusiasts alike. Factors such as supply and demand, market capitalization, circulating supply, technological developments, market sentiment, regulatory environment, adoption, and price manipulation all play a role in determining the value of cryptocurrencies. By staying informed about these factors and monitoring market trends, investors can make more informed decisions about their cryptocurrency investments.

In conclusion, the world of cryptocurrencies is complex and ever-changing. By gaining a deeper understanding of the factors that influence cryptocurrency prices, you can stay ahead of the curve and make more informed decisions about your investments.