Understand what is a limit order in crypto trading and how it works, along with the benefits and drawbacks of using limit orders in your trading strategy.

As you venture into the world of cryptocurrency trading, understanding different order types can make a significant difference in your success. One essential order type to grasp is the limit order. In this article, we will discuss what is a limit order in crypto, how it works, and its advantages and disadvantages.

1. An Overview of Cryptocurrency Trading

Before diving into what is a limit order, it’s crucial to have a basic understanding of cryptocurrency trading. Crypto trading involves buying, selling, and exchanging digital assets such as Bitcoin, Ethereum, and various altcoins with the aim of making a profit. Traders look to capitalize on price fluctuations in the market, often using different types of orders to execute their trades.

2. Common Order Types in Crypto Trading

Traders can use several types of orders when trading cryptocurrencies, each with its own set of characteristics and use cases. Some of the most common order types include:

- Market Order

- Limit Order

- Stop-Loss Order

- Take-Profit Order

Now let’s focus on what is a limit order in crypto and how it works.

3. What is a Limit Order?

A limit order is an instruction to buy or sell a cryptocurrency at a specific price or better. This type of order allows traders to set a precise price at which they wish to execute their trade, giving them more control over the execution price compared to a market order. Limit orders are typically used when a trader wants to enter or exit a position at a favorable price, and they are willing to wait for the market to reach that price.

4. How Limit Orders Work in Crypto Trading

When a trader places a limit order, they are essentially telling the exchange to execute the trade only if the market reaches the specified price. Here’s a step-by-step explanation of how limit orders work in crypto trading:

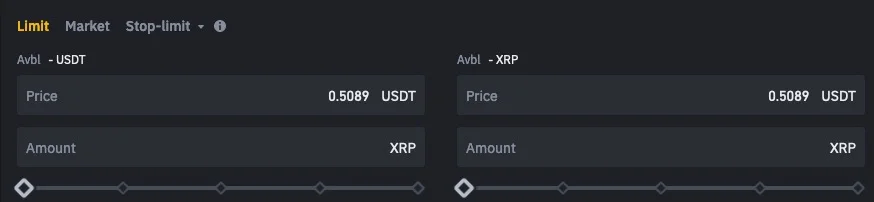

- Placing the Order: The trader submits a limit order to buy or sell a specific amount of a cryptocurrency at a specified price on an exchange platform.

- Order Added to the Order Book: The limit order is added to the exchange’s order book, where it is visible to other traders and can be matched with opposite orders.

- Order Execution: The limit order is executed when the market price reaches the specified price or better. If there are not enough opposite orders at the specified price to fulfill the limit order, it may be partially executed.

- Order Completion: Once the limit order has been fully executed, the trader receives a confirmation detailing the total amount of cryptocurrency bought or sold and the price at which the trade was executed.

5. Advantages of Limit Orders in Crypto Trading

Limit orders offer several advantages for crypto traders, including:

Price Control

One of the main benefits of using a limit order is the ability to set a specific price at which you want to buy or sell a cryptocurrency. This gives traders more control over their execution price and can help them achieve better results.

Eliminated Slippage

Slippage occurs when the execution price of an order differs from the expected price due to market fluctuations. Since limit orders are only executed at the specified price or better, they can help reduce slippage, leading to more predictable trading outcomes.

Passive Income Potential

Limit orders can be used to provide liquidity to the market by placing orders on both sides of the order book. In some cases, exchanges offer fee discounts or other incentives to traders who use limit orders to provide liquidity, potentially generating passive income.

6. Disadvantages of Limit Orders in Crypto Trading

Despite their advantages, limit orders also come with some drawbacks:

No Execution Guarantee

Since limit orders are only executed when the market reaches the specified price, there is no guarantee that a limit order will be filled. If the market never reaches the price set by the trader, the limit order may remain open indefinitely.

Missed Opportunities

While waiting for the market to reach the specified price, traders using limit orders may miss out on opportunities to enter or exit positions at different price levels. This can be particularly detrimental during periods of high volatility when the market moves quickly.

Reduced Speed

Limit orders prioritize price control over speed, which means they may not be executed as quickly as market orders. In fast-moving markets, this delay can lead to missed trading opportunities or unfavorable price changes.

7. Limit Orders vs. Market Orders

One of the main alternatives to limit orders is market orders. While limit orders allow traders to specify the exact price at which they want to buy or sell a cryptocurrency, market orders prioritize speed and are executed at the best available price.

Here’s a comparison of limit orders and market orders:

- Speed: Market orders are executed immediately, while limit orders may remain open until the market reaches the specified price.

- Price Control: Limit orders offer traders more control over the execution price, while market orders can result in unexpected prices due to market fluctuations and slippage.

- Complexity: Limit orders require more experience and understanding of market dynamics, while market orders are simpler and easier to understand, making them suitable for beginner traders.

8. When to Use Limit Orders in Crypto Trading

Deciding whether to use a limit order or another type of order will depend on your trading strategy, risk tolerance, and market conditions. Here are some scenarios where using a limit order may be suitable:

- Seeking a Specific Price: If you have a target price in mind for entering or exiting a position, a limit order can help you achieve that price or better, provided the market reaches your specified price.

- Reducing Slippage: Limit orders can help minimize slippage by ensuring that your trade is executed at the specified price or better, leading to more predictable trading outcomes.

- Providing Liquidity: If you are interested in generating passive income by providing liquidity to the market, limit orders can be an effective way to place orders on both sides of the order book and potentially earn fee discounts or other incentives.