Your guide to what Ripple’s ODL is and how it works. Explore how this groundbreaking technology is shaping the future of global transactions.

Often a question arises, “What is Ripple’s ODL and how it works?” To truly grasp the innovation that Ripple has brought to the financial sector, one must comprehend its groundbreaking product, On-Demand Liquidity (ODL). This revolutionary technology is transforming the world of international finance, making cross-border transactions more efficient, faster, and cheaper.

What is Ripple’s ODL (On-Demand Liquidity) – Definition

Ripple’s On-Demand Liquidity, or ODL, is a service that utilizes XRP, a digital asset, to enable instant money transfers. Before delving into how Ripple’s ODL works, it’s essential to understand the problem it addresses.

Cross-border transactions traditionally involve pre-funded accounts in recipient countries, resulting in capital being tied up and the process becoming slow and expensive. ODL seeks to eradicate these issues by providing liquidity on demand using XRP as a bridge currency between two fiat currencies.

How Ripple’s ODL Works

Answering what is Ripple’s ODL and how it works requires understanding the mechanics of a transaction within this system.

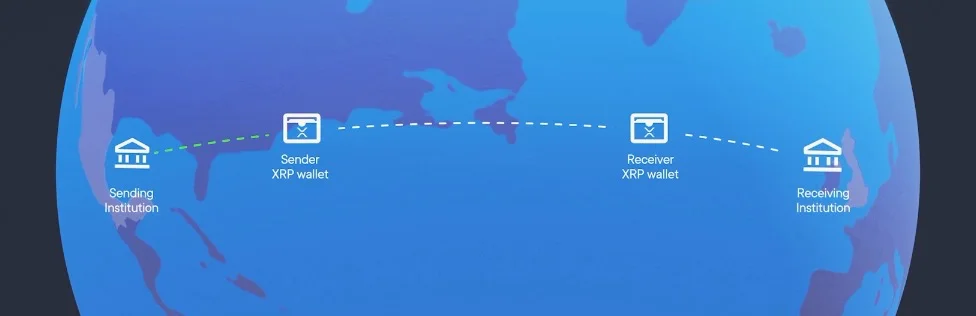

- A financial institution that is part of RippleNet initiates a payment transaction via ODL.

- ODL sources the most cost-effective and readily available XRP for the transaction, usually from a digital asset exchange in the sender’s country.

- XRP is then transferred to a digital asset exchange in the recipient’s country within seconds, thanks to the high speed of transactions on the XRP Ledger.

- The XRP is then exchanged for the destination currency, which is subsequently sent to the recipient.

The beauty of this system is that the entire process takes just a few minutes, compared to traditional methods which can take days. Also, it eliminates the need for pre-funding, freeing up capital for financial institutions.

Ripple’s ODL: Breaking Down Borders

One of the key features of Ripple’s ODL is that it effectively breaks down the barriers that have long existed in international finance. By providing liquidity on demand, ODL eliminates the need for banks and other financial institutions to maintain capital in nostro accounts across the globe. This not only helps to reduce costs but also makes the entire process of sending money across borders more streamlined and efficient.

Moreover, the use of a digital asset like XRP as a bridge currency means that ODL can work with any currency—fiat or digital. It’s an inclusive, universal system, and its potential to revolutionize international finance is immense.

The Impact of Ripple’s ODL

Since its launch, Ripple’s ODL has been gaining traction among financial institutions around the world. For example, Tranglo, one of the world’s largest money transfer companies, has been using ODL to handle a significant portion of its transactions across multiple corridors.

The impact of ODL has also extended beyond traditional financial institutions. Fintech companies and remittance services have been able to reduce costs and improve customer experience through faster, more reliable payment services.

Future of Ripple’s ODL

The future looks bright for Ripple’s ODL. With the continuous growth of digital transactions, the demand for efficient, cost-effective solutions is also increasing. As more institutions understand the answer to what Ripple’s ODL is and how it works and appreciate the benefits it provides, adoption is likely to rise.

Ripple is also continually refining its technology and expanding its network of partners, ensuring that ODL will continue to evolve and improve to meet the needs of the changing financial landscape.

Conclusion

As we answer the question, what is Ripple’s ODL and how it works, it’s clear that Ripple’s ODL is much more than just a digital payment solution. It’s a revolutionary technology that’s changing the way we think about international finance, making it faster, more efficient, and more inclusive.

Ripple’s ODL works by employing XRP as a bridge currency, enabling transactions to be settled in minutes rather than days. It does away with the need for pre-funding accounts, freeing up capital for financial institutions and making the entire process more cost-effective.

In essence, Ripple’s ODL is a perfect example of how blockchain technology can solve real-world problems. By leveraging the speed and efficiency of the XRP Ledger, Ripple has been able to deliver a product that truly meets the needs of the modern financial landscape.

As more people and institutions come to understand what Ripple’s ODL is and how it works, we can expect to see its influence grow. Whether it’s traditional banks, fintech startups, or remittance services, a wide range of financial institutions can benefit from the efficiencies that ODL provides.

Ultimately, Ripple’s On-Demand Liquidity is not just a product; it’s a vision for a more efficient and inclusive financial system. And as we move into the future, it’s a vision that is likely to become increasingly relevant.