Unlock the potential of stop limit orders in crypto trading. Explore how they work and boost your trading prowess with this article.

As a cryptocurrency trader, familiarizing yourself with different order types is crucial to enhancing your trading strategies and maximizing your profits. One such advanced trading tool is the stop limit order in crypto trading. In this in-depth article, we will discuss what a stop limit order is, how it works, and its benefits in the world of crypto trading.

What is a Stop Limit Order in Crypto Trading?

A stop limit order is a sophisticated trading tool that combines the features of both a stop order and a limit order. It enables traders to buy or sell a cryptocurrency at a specific price or better, once the market price reaches a predetermined stop price. Essentially, a stop limit order allows you to set a price threshold and execute a trade only when that threshold is met or surpassed, giving you more control over your entry or exit points in the market.

How Stop Limit Orders Work

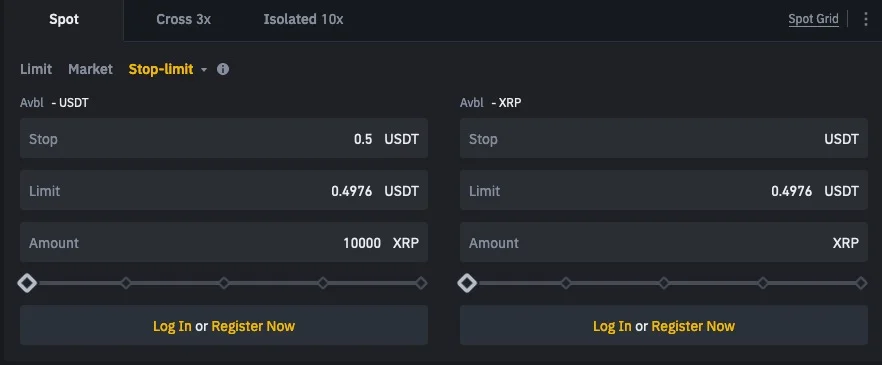

To understand how a stop limit order works in crypto trading, it’s essential to break it down into its two components:

- Stop Price: This is the trigger price that, once reached or crossed, activates the limit order.

- Limit Price: The specific price or better at which you want to buy or sell the cryptocurrency once the stop price is met.

When you place a stop limit order, the order remains inactive until the market reaches the stop price. Once the stop price is reached, the stop limit order turns into a limit order, which is then executed at the limit price or better. This allows you to have more control over your entry or exit points in the market, minimizing potential losses or locking in profits.

Benefits of Stop Limit Orders in Crypto Trading

Stop limit orders offer several advantages in cryptocurrency trading, including:

- Risk Management: By setting a stop price, you can limit your losses in case the market moves against your expectations. For instance, if you own Bitcoin and the market price starts to decline, you can set a stop limit sell order below the current market price. If the price falls to your stop price, the limit sell order will be activated, preventing further losses.

- Profit Protection: Stop limit orders can be used to lock in profits by automatically selling your position once the market reaches a specific price. This helps ensure that you don’t miss out on potential gains in a rapidly fluctuating market.

- Increased Control: Stop limit orders give you more control over your trades, allowing you to enter or exit the market at a desired price. This is particularly helpful in volatile markets, where prices can change dramatically in a short amount of time.

Tips for Using Stop Limit Orders in Crypto Trading

To make the most of stop limit orders in your trading strategies, consider the following tips:

- Choose the Right Stop Price: When setting a stop price, ensure that it’s not too close to the current market price. If it’s too close, the stop limit order may be triggered by minor price fluctuations, potentially causing you to exit a position prematurely or enter a trade at an undesirable price.

- Adjust Your Stop Price: As the market evolves, you may need to adjust your stop price to better suit your trading strategy. For example, if your initial stop price was set to protect against a loss, you may want to move it higher as the market price increases to lock in profits.

- Consider the Order Book: Before placing a stop limit order, review the order book for the cryptocurrency you’re trading. This will give you an idea of the market’s liquidity and help you determine the best stop and limit prices for your order.

- Monitor Your Orders: While stop limit orders provide an automated way to manage your trades, it’s essential to keep an eye on your orders and monitor market conditions. In cases of extreme volatility or low liquidity, your stop limit order may not be executed at the desired price or may not be executed at all.

- Use Stop Limit Orders in Conjunction with Other Strategies: Stop limit orders are a valuable tool, but they shouldn’t be your only strategy in crypto trading. Combine them with other order types, technical analysis, and fundamental analysis to build a comprehensive trading approach.

- Practice Makes Perfect: Before implementing stop limit orders in your live trading, consider using a demo account or trading simulator to familiarize yourself with their mechanics and develop your skills. This practice will help you become more comfortable and confident when using stop limit orders in real trading scenarios.

Potential Drawbacks of Stop Limit Orders

Despite their numerous advantages, stop limit orders also have potential drawbacks that you should be aware of:

- No Guarantee of Execution: Although stop limit orders provide more control over your trades, there’s no guarantee that your order will be executed at the specified limit price. If the market moves too quickly past your limit price or there’s insufficient liquidity, your order may not be filled.

- Additional Fees: Some exchanges may charge additional fees for stop limit orders, as they’re considered advanced order types. Make sure to review the fee structure of your preferred exchange before placing a stop limit order.

Conclusion

Understanding what is a stop limit order in crypto trading and how it works is essential for traders looking to enhance their strategies and manage risks more effectively. By combining the features of stop orders and limit orders, stop limit orders provide increased control over your trades, allowing you to better manage your risks and maximize your profits.

However, it’s crucial to be aware of the potential drawbacks and utilize stop limit orders in conjunction with other trading strategies and tools. With practice and a comprehensive understanding of stop limit orders, you’ll be better equipped to navigate the world of crypto trading and achieve success in this dynamic market.