Dive into RippleNet’s unique approach to international money transfers, leveraging advanced blockchain technology.

RippleNet is a revolutionary global payments network developed by Ripple, aiming to make cross-border transactions quicker, cheaper, and more reliable. This network is a game-changer in the realm of international finance, offering a unique approach to transferring money across different networks.

In this article, we delve deeper into the world of RippleNet, exploring its purpose, benefits, how it works, its users, and more.

What is RippleNet – Definition

RippleNet is a global payment network developed by Ripple, aimed at revolutionizing the financial sector by making cross-border transactions faster, more reliable, and cost-effective. It achieves this by leveraging advanced blockchain technology, thus reducing the friction traditionally associated with international money transfers.

It achieves this through several key features:

- Bi-directional messaging: This enables more effective communication between the parties involved in a transaction, reducing errors and delays.

- Optimized settlement: RippleNet’s infrastructure allows for faster settlement of transactions, reducing the time it takes for money to move from one party to another.

- Unique liquidity solutions: RippleNet offers innovative solutions to liquidity issues that can arise in international transfers, improving efficiency and reducing costs.

RippleNet’s customers encompass a broad array of institutions, including traditional remitters, digital remitters, FX brokers, payment service companies, global tier-1 banks, multi-country regional banks, local banks, digital banks, and different types of corporations. This diverse network of interconnected customers, partners, and infrastructure providers allows RippleNet to facilitate efficient global payments.

How RippleNet works

RippleNet is a peer-to-peer distributed application developed by Ripple that aims to streamline cross-border transactions for financial institutions. It achieves this by maintaining a virtual ledger that emulates Nostro and Vostro accounts, traditional bank accounts used in international banking to simplify the transfer of funds.

The system is composed of two main layers: a bi-directional messaging layer and a settlement layer. These two components work together to allow for efficient, rapid transfers of money across different borders and currencies.

Rather than directly interfacing with a financial institution’s core banking systems, middleware integrates with RippleNet. This is done through API operations that replicate the funding into RippleNet’s virtual accounts. This approach provides a level of abstraction that makes integration easier and more secure.

In terms of infrastructure, RippleNet is hosted in a cloud environment by Ripple itself. This significantly reduces the costs related to on-site technical infrastructure for the institutions using RippleNet. Ripple handles all aspects of maintenance, upgrades, and 24/7 monitoring, thereby reducing the need for additional hardware and staffing expenses. This arrangement also ensures high quality of service for customers.

Security is a top priority for RippleNet. It is SOC 2 certified, indicating that it has passed rigorous independent audits and has robust safeguards in place for security, availability, confidentiality, and privacy.

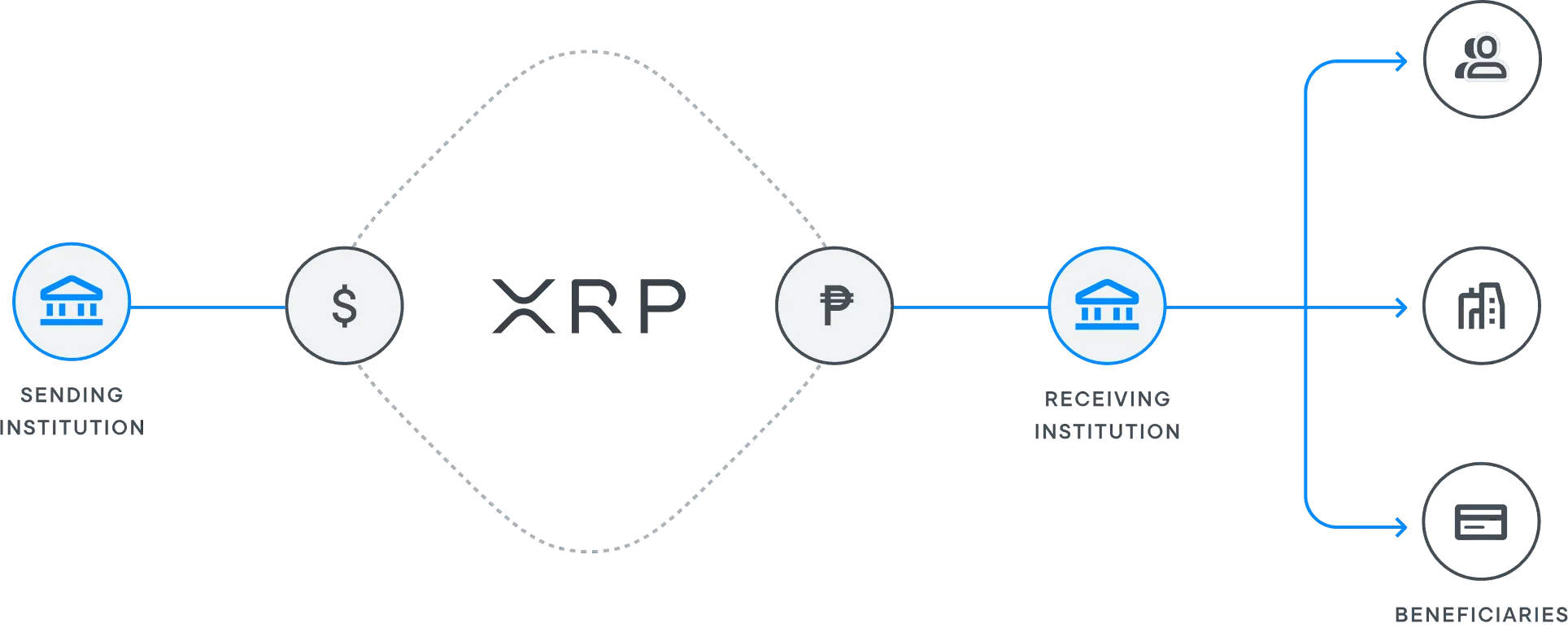

The use of XRP within ODL

One of the key features of RippleNet is its On-Demand Liquidity (ODL) solution. ODL allows customers to move money across borders and currencies instantly, without the need to pre-fund accounts in different markets. This reduces operational costs and frees up working capital for organizations. Moreover, ODL operates continuously, 24/7/365, which substantially speeds up the process of cross-border settlement.

ODL leverages the digital asset XRP as a bridge currency, sourcing liquidity on-demand and moving funds in real time. This makes it a highly efficient and cost-effective solution for international financial transactions.

Conclusion

In conclusion, RippleNet represents a paradigm shift in global finance, bringing unprecedented speed, reliability, and cost-effectiveness to cross-border transactions. By leveraging advanced blockchain technology and the digital asset XRP, RippleNet offers innovative solutions to traditional issues in international money transfers, such as liquidity management and communication inefficiencies. Its unique approach to bi-directional messaging, optimized settlement, and unique liquidity solutions underscores its commitment to revolutionizing the financial sector.

RippleNet’s diverse customer base, which includes a variety of financial institutions and corporations, is a testament to its versatility and wide-reaching impact. Furthermore, its robust security measures and cloud-based infrastructure ensure a secure and reliable service for its customers. Through its innovative On-Demand Liquidity solution, RippleNet is redefining the way organizations move funds across borders, freeing up working capital and reducing operational costs.

As the financial world continues to evolve, RippleNet stands at the forefront of this transformation, challenging traditional norms and paving the way for a more efficient and inclusive global financial system. Its revolutionary approach to cross-border payments is not just a significant stride towards financial innovation, but also a beacon of potential for the future of international finance.