Discover what is APY in DeFi and how to calculate it to maximize your returns in the decentralized finance ecosystem.

Decentralized finance (DeFi) has emerged as a game-changer in the financial industry, enabling users to access a variety of financial services without relying on traditional intermediaries like banks. One of the most significant aspects of DeFi is its potential for earning passive income through lending, borrowing, and providing liquidity. To understand and capitalize on this potential, it is essential to answer the question: What is APY in DeFi? This comprehensive guide will explore the concept of APY, its role in DeFi, and how to calculate and assess it to make informed investment decisions.

What is DeFi?

Decentralized Finance (DeFi) is an innovative financial ecosystem built on blockchain technology. It empowers users to control their assets and access financial services such as lending, borrowing, trading, and earning interest on deposits without the need for intermediaries like banks or traditional financial institutions. DeFi platforms leverage smart contracts to automate and secure transactions, thereby offering increased transparency, accessibility, and financial inclusion.

What is APY – Definition

Annual Percentage Yield (APY) is a metric that expresses the return on an investment over a year, taking into account the effect of compounding interest. APY is widely used in both traditional finance and DeFi to compare the potential returns from different investment opportunities. A higher APY indicates a more profitable investment, assuming that all other factors, such as risk and fees, are equal.

The Role of APY in DeFi

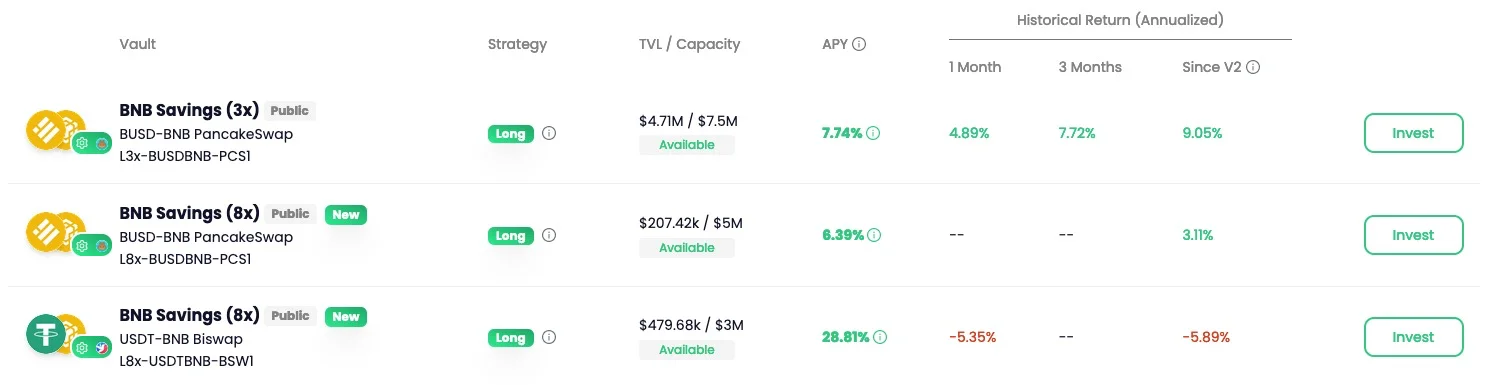

In DeFi, APY is a crucial metric for users looking to invest in various platforms and protocols. It helps them compare the potential returns from different opportunities, such as lending platforms, liquidity pools, and yield farming programs. APY provides a standardized measure to assess the performance of these investments, enabling users to make more informed decisions and allocate their resources more effectively.

How is APY Calculated in DeFi?

The APY calculation in DeFi is similar to traditional finance, with one key difference: the interest is typically compounded more frequently, often daily or even per block. The formula to calculate APY is as follows:

APY = (1 + r/n)^(nt) – 1

Where:

APYis the annual percentage yieldris the nominal interest ratenis the number of times interest is compounded per yeartis the time (in years)

By plugging in the relevant values, you can determine the APY for a given DeFi investment.

Factors Affecting APY in DeFi

Several factors can influence the APY in DeFi, which investors must consider when making decisions:

- Platform’s interest rates: DeFi platforms set their own interest rates based on supply and demand, which directly impact APY. A higher demand for borrowing and a lower supply of funds can lead to higher interest rates and, consequently, higher APY.

- Token price fluctuations: The value of the tokens you invest in can affect your overall return. If the price of the token increases, your APY will also rise. Conversely, if the token’s value decreases, your APY will decline.

- Impermanent loss: In the case of liquidity pools, impermanent loss can impact APY. Impermanent loss occurs when the value of the tokens in a liquidity pool changes relative to each other, resulting in a potential reduction in returns for liquidity providers.

- Platform fees: Some DeFi platforms charge fees for their services, such as withdrawal fees, transaction fees, or performance fees. These fees can lower your overall returns and, in turn, affect your APY.

- Staking rewards and incentives: DeFi platforms often offer additional rewards or incentives, such as governance tokens or bonus yields, to encourage user participation. These rewards can boost APY, making certain investments more attractive.

Risks and Benefits of APY in DeFi

While DeFi offers potentially higher APY compared to traditional finance, it comes with certain risks that investors need to consider:

- Smart contract vulnerabilities: DeFi platforms rely on smart contracts, which can have vulnerabilities or bugs. These vulnerabilities can result in losses for investors.

- Market volatility: Cryptocurrency markets are notoriously volatile, and DeFi investments are not immune to these fluctuations. This volatility can impact the value of your investments and, subsequently, your APY.

- Regulatory uncertainty: DeFi operates in a relatively new and rapidly evolving regulatory environment. Changes in regulations or enforcement actions can impact the viability of DeFi platforms and the value of their tokens.

However, DeFi also offers numerous benefits:

- Financial inclusion: DeFi platforms enable anyone with an internet connection and a digital wallet to access financial services, regardless of their location or credit history.

- Increased accessibility: DeFi platforms operate 24/7 and are accessible from anywhere in the world, allowing users to manage their investments and earn passive income without the constraints of traditional banking hours or geographical limitations.

- Transparency: Blockchain technology provides an immutable and transparent record of transactions, giving users greater visibility into the performance of their investments and the overall health of the DeFi ecosystem.

Strategies to Maximize APY in DeFi

To maximize APY in DeFi, investors can employ various strategies, such as:

- Diversification: Allocating funds across multiple platforms and investment opportunities can help minimize risk and increase the potential for higher returns.

- Research and due diligence: Conduct thorough research on DeFi platforms, their tokenomics, and any associated risks before investing. This will help you make informed decisions and select the most promising opportunities.

- Monitoring and rebalancing: Keep track of your investments and the performance of different DeFi platforms. Rebalance your portfolio periodically to maintain an optimal risk-reward profile and take advantage of new opportunities.

- Risk management: Always consider the potential risks associated with DeFi investments and adjust your strategies accordingly. Ensure that you are not overexposed to any single platform or token.

Conclusion

Understanding what is APY in DeFi is essential for investors looking to maximize their returns in the decentralized finance ecosystem. By knowing how to calculate and assess APY, you can make more informed decisions about your DeFi investments, taking into account factors such as interest rates, token price fluctuations, and platform fees. By carefully managing risks and employing strategies to optimize your APY, you can capitalize on the numerous opportunities offered by the rapidly growing DeFi space.