Don’t be intimidated by centralized crypto exchanges. Our beginner’s guide breaks down how centralized exchanges work, so you can buy and sell with ease.

Centralized crypto exchanges are one of the primary ways to trade cryptocurrencies, and understanding how they work is essential for anyone looking to invest in cryptocurrencies.

In this article, we will explore how centralized crypto exchanges work, from the basics of what they are to the details of how to use them to buy and sell cryptocurrencies.

What is a Centralized Crypto Exchange – definition

A centralized crypto exchange is a platform that allows users to buy and sell cryptocurrencies. It is called centralized because it is operated by a single company that controls the exchange’s servers, security, and user accounts.

Users create an account on the exchange, deposit funds, and use those funds to buy and sell cryptocurrencies.

How do Centralized Crypto Exchanges Work?

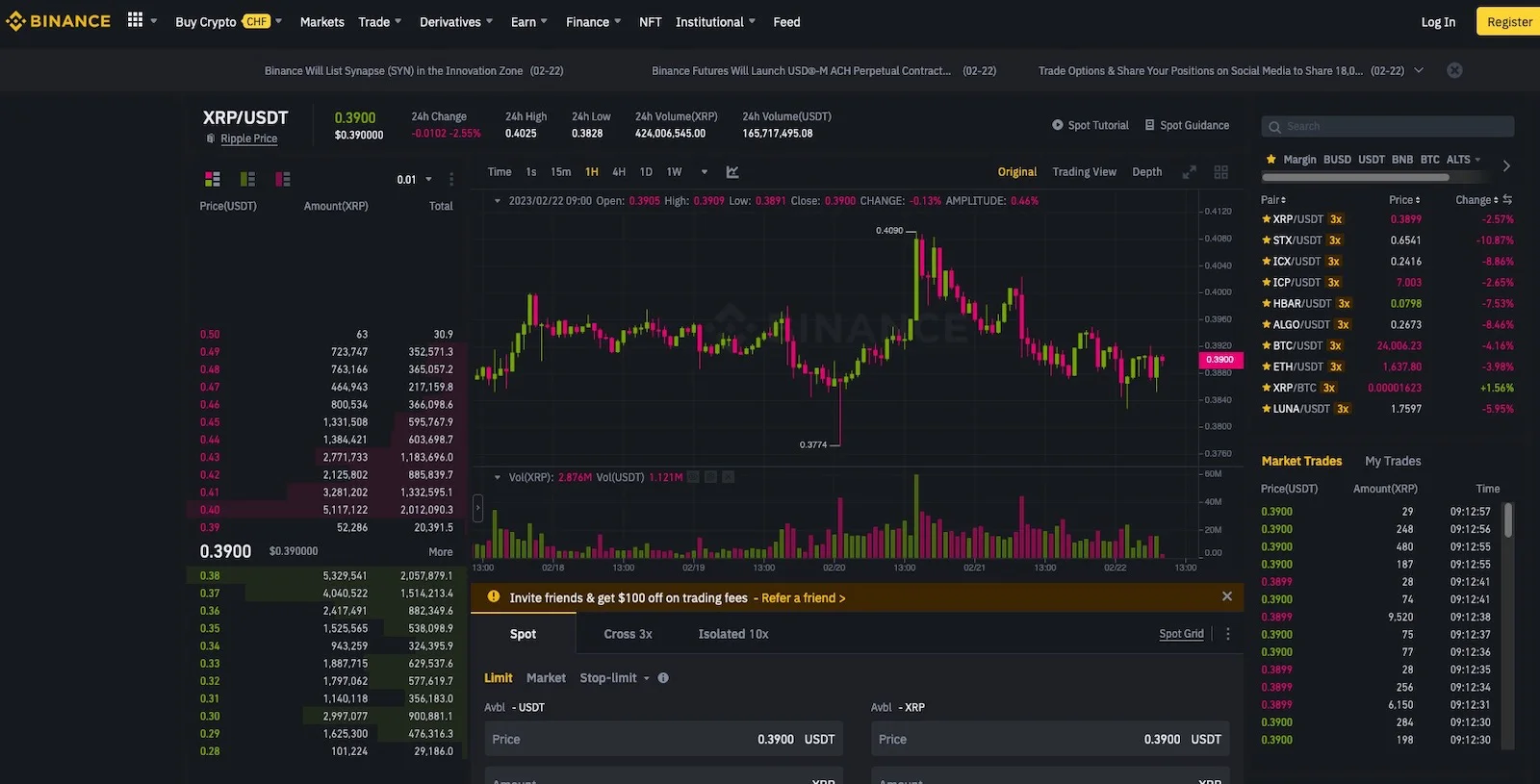

Centralized crypto exchanges operate similarly to traditional stock exchanges, with the buying and selling of cryptocurrencies taking place on an order book. An order book is a list of buy and sell orders for a particular cryptocurrency. When a user places an order to buy or sell a cryptocurrency, it is added to the order book.

When a user places a buy order, they specify the amount of cryptocurrency they want to purchase and the price they are willing to pay. When a user places a sell order, they specify the amount of cryptocurrency they want to sell and the minimum price they are willing to accept.

If a buy and sell order match, a trade is executed, and the cryptocurrency is transferred from the seller’s account to the buyer’s account.

Trading pairs are also an essential part of centralized crypto exchanges. A trading pair is a combination of two cryptocurrencies that can be traded against each other. For example, Bitcoin and Ethereum are a trading pair on many exchanges. Users can buy and sell either cryptocurrency using the other as the base currency.

Fees and market makers are other crucial aspects of centralized crypto exchanges. Fees are charged to users for every trade they make on the exchange. The fees vary from exchange to exchange but are typically a percentage or less of the trade amount.

Market makers are individuals or companies that provide liquidity to the exchange by placing buy and sell orders on the order book. They help ensure that there is always a buyer or seller for a particular cryptocurrency, which is essential for the exchange’s smooth operation. In return for providing this service, market makers receive a portion of the trading fees.

Security and Regulation of Centralized Crypto Exchanges

Security is a significant concern for users of centralized crypto exchanges, as hacks and thefts of user funds have occurred in the past. Exchanges employ various security measures to protect user funds, including two-factor authentication, cold storage, and regular security audits. Cold storage is a method of storing cryptocurrency offline, which makes it less vulnerable to hacking.

Regulation is another concern for centralized crypto exchanges. Many countries have implemented regulations to ensure that exchanges are not being used for illicit purposes, such as money laundering or terrorism financing. Exchanges that operate in regulated countries must comply with these regulations and are subject to audits and inspections.

Popular Centralized Crypto Exchanges

There are numerous centralized crypto exchanges to choose from, each with its strengths and weaknesses. Some of the most popular exchanges include Binance, Coinbase, and Kraken.

Binance has become one of the largest and most popular exchanges in the world. It offers a vast array of trading pairs, low fees, and a user-friendly interface.

Coinbase is a US-based exchange that is known for its user-friendly interface and high level of security. It also offers a range of educational resources for users who are new to cryptocurrencies.

Kraken is a US-based exchange that offers a wide range of trading pairs and advanced trading tools for experienced traders. It is known for its high level of security and transparency, with regular audits and reports published on its website.

Conclusion

In conclusion, centralized crypto exchanges play a crucial role in the cryptocurrency ecosystem by providing a platform for users to buy and sell cryptocurrencies. Understanding how they work is essential for anyone looking to invest in cryptocurrencies, as it allows them to navigate the complexities of trading and choose the exchange that best suits their needs.

When using a centralized crypto exchange, it is important to be aware of the security risks and to take steps to protect your funds, such as using two-factor authentication and storing your cryptocurrencies in a secure wallet.