Get a detailed understanding of how do crypto exchanges work. Discover the essentials of trading, security, and revenue models.

A key part of the crypto ecosystem that enables the buying, selling, and trading of these digital assets are cryptocurrency exchanges. If you’ve ever asked yourself how do crypto exchanges work, this comprehensive guide is for you.

What is a Crypto Exchange?

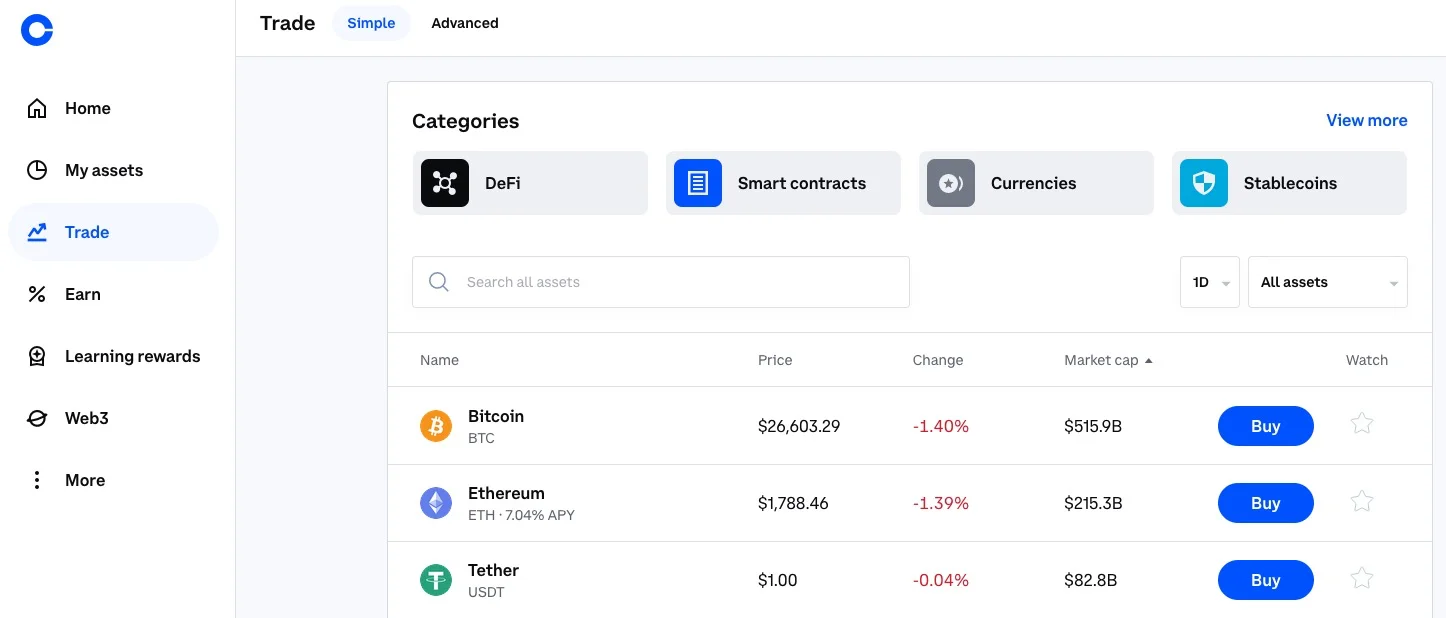

In the simplest terms, a cryptocurrency exchange is a platform that allows individuals to buy, sell, or trade cryptocurrencies for other digital assets or fiat currencies (like USD or EUR). Understanding how crypto exchanges work begins with understanding the various types of exchanges: centralized exchanges (CEXs), decentralized exchanges (DEXs), and hybrid exchanges.

Centralized Exchanges (CEXs)

Centralized exchanges are platforms that function as intermediaries to facilitate crypto transactions. These exchanges are run by a central authority or company that controls all transactions. Examples include Binance, Coinbase, and Kraken. These exchanges often offer high liquidity and trading volume, but their centralized nature means users have to trust the exchange with their funds.

Decentralized Exchanges (DEXs)

Decentralized exchanges operate without a central authority. Instead, they run on blockchain technology and use smart contracts to automate the trading process. Examples include Uniswap, Sushiswap, and PancakeSwap. While DEXs provide more privacy and control, they often have lower trading volume and liquidity compared to CEXs.

Hybrid Exchanges

Hybrid exchanges aim to combine the advantages of both CEXs and DEXs. These platforms offer the liquidity and trading volume of centralized exchanges while maintaining the privacy and control of decentralized exchanges.

How Crypto Exchanges Work: The Basics

The basic working of a cryptocurrency exchange involves a simple process:

- Registration: First, a user has to register on the exchange platform, providing some personal details to create an account.

- Verification: Depending on the platform and the amount to be traded, the user may need to go through a verification process.

- Deposit: The user deposits fiat currency or cryptocurrency into their account.

- Trading: The user can then start trading, either buying or selling cryptocurrencies.

- Withdrawal: After trading, the user can withdraw their cryptocurrencies or fiat currency to their personal wallet or bank account.

Order Book and Market Orders

To fully understand how crypto exchanges work, it’s crucial to know about order books and market orders.

An order book is a real-time list of buy and sell orders for a specific cryptocurrency, organized by price level. The order book identifies the number of buy orders (also known as bids) and sell orders (also known as asks) at each price point or market depth.

Users place market orders (buy or sell) that are fulfilled by matching with orders in the order book. When a market order is placed, it’s executed immediately at the current market price.

Limit Orders and Stop Orders

Apart from market orders, users can place limit orders and stop orders. A limit order sets a specific price at which the user wants to buy or sell a cryptocurrency. This order will only be executed if the market price reaches the user’s specified price.

A stop order (also known as a stop-loss order) is a type of order that becomes a market order once a certain price level is reached. It’s used to limit losses if the market moves against a user’s position.

How Crypto Exchanges Make Money

A vital part of understanding how crypto exchanges work is knowing how they make money. Here are the primary revenue sources for most crypto exchanges:

- Trading Fees: Exchanges charge fees on every transaction conducted on their platform. These fees typically range from 0.1% to 0.5% of the transaction amount.

- Deposit and Withdrawal Fees: Some exchanges charge fees when users deposit or withdraw funds from their accounts.

- Listing Fees: New cryptocurrencies might pay an exchange for the opportunity to be listed and thus become available for trading to the exchange’s users.

- Margin Trading Fees: Exchanges that offer margin trading — trading with borrowed funds — may charge interest on the borrowed amount.

Security Measures on Crypto Exchanges

Security is a major concern for crypto exchanges, given the digital and often unregulated nature of the crypto space. Some common security measures include:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring users to provide two forms of identification before accessing their accounts.

- Cold Storage: Exchanges often keep a large portion of their assets offline in cold storage to protect them from potential hacking attempts.

- Encryption: Exchanges use encryption technology to protect user data.

- Know Your Customer (KYC) and Anti-Money Laundering (AML) Policies: Exchanges implement KYC and AML policies to verify user identities and prevent illegal activities.

Conclusion

In essence, the answer to how do crypto exchanges work involves understanding the different types of exchanges, the process of trading on an exchange, and the security measures in place to protect user funds and data. Whether you’re a beginner looking to make your first crypto purchase or a seasoned trader, understanding how crypto exchanges work is crucial to navigate the ever-evolving crypto landscape.