Tired of centralized exchanges? Our guide on how decentralized exchanges work can help you take control of your cryptocurrency trading and get the privacy and security you need.

Cryptocurrency enthusiasts have been quick to point out the drawbacks of centralized exchanges, which are operated by a single company that controls the exchange’s servers, security, and user accounts. Decentralized exchanges offer a viable alternative, but you have to first understand how they work.

In this article, we will explore how decentralized crypto exchanges work, from the basics of what they are to the details of how to use them to buy and sell cryptocurrencies.

What is a decentralized crypto exchange – definition

A decentralized crypto exchange is a platform that allows users to buy and sell cryptocurrencies without the need for a central authority to manage the exchange.

Decentralized exchanges use smart contracts, which are self-executing contracts that operate on the blockchain, to facilitate the buying and selling of cryptocurrencies.

This means that transactions take place directly between users, without the need for a central authority to manage the exchange.

How do decentralized crypto exchanges work?

Decentralized crypto exchanges operate on a peer-to-peer (P2P) basis, which means that buyers and sellers interact directly with each other, rather than going through a central authority. When a user wants to buy or sell a cryptocurrency, they create a smart contract that specifies the details of the transaction, such as the cryptocurrency being bought or sold, the price, and the expiration date.

Once the smart contract is created, it is broadcast to the blockchain network, where it is validated by other users on the network. Once the contract is validated, it is executed automatically, and the cryptocurrency is transferred directly from the seller’s account to the buyer’s account.

Trading on a decentralized exchange can be slower than on a centralized exchange, as each transaction needs to be validated by other users on the network. However, decentralized exchanges offer several benefits, such as greater security, and greater privacy.

Security and regulation of decentralized crypto exchanges

Security is a significant concern for users of decentralized crypto exchanges, as hacks and thefts of user funds have occurred in the past. Decentralized exchanges employ various security measures to protect user funds, including multisig wallets, two-factor authentication, and regular security audits. Multisig wallets require multiple signatures to authorize a transaction, which makes them less vulnerable to hacking.

Regulation is another concern for decentralized crypto exchanges, as they operate without the need for a central authority to manage the exchange. As a result, they are often subject to less regulation than centralized exchanges. However, many countries have implemented regulations to ensure that decentralized exchanges are not being used for illicit purposes, such as money laundering or terrorism financing.

Popular decentralized crypto exchanges

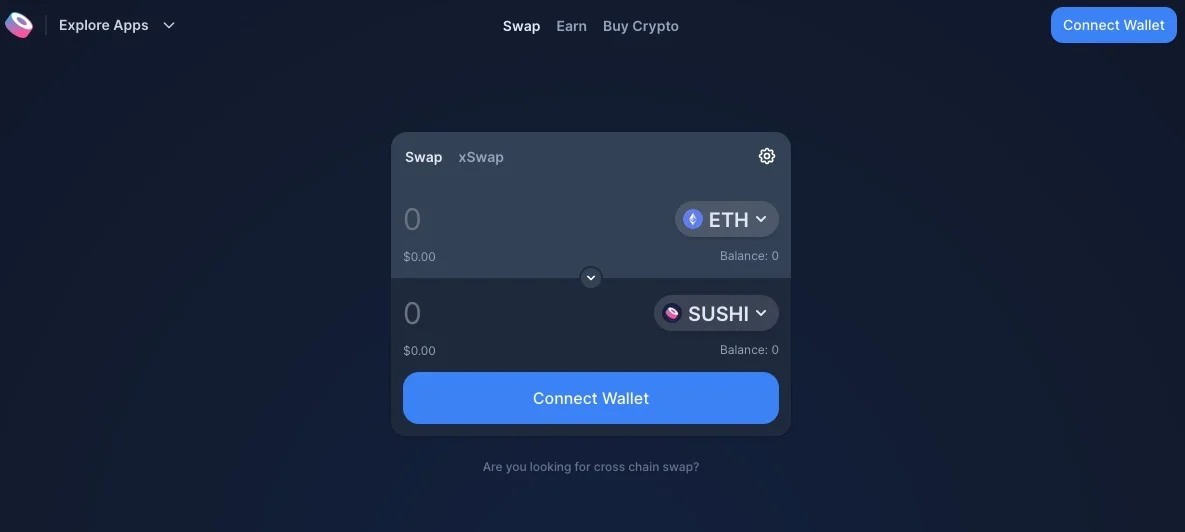

There are several popular decentralized crypto exchanges to choose from, each with their strengths and weaknesses. Some of the most popular decentralized exchanges include Uniswap, SushiSwap, and Curve.

Uniswap is a decentralized exchange that operates on the Ethereum blockchain. It is known for its user-friendly interface and low fees. It offers a wide range of trading pairs, and users can create liquidity pools to earn fees.

SushiSwap is another decentralized exchange that operates on the Ethereum blockchain. It offers a range of trading pairs and liquidity pools, as well as a governance token that allows users to vote on the direction of the platform.

Curve is a decentralized exchange that focuses on stablecoins. It allows users to trade stablecoins with low fees and offers a range of liquidity pools.

Comparison of centralized and decentralized crypto exchanges

Centralized and decentralized crypto exchanges offer different benefits and drawbacks. Centralized exchanges offer greater liquidity and faster trades, but they are often more vulnerable to hacking and subject to greater regulation. Decentralized exchanges offer greater security and privacy, but they are often slower and less liquid.

Conclusion

In conclusion, decentralized crypto exchanges offer a viable alternative to centralized exchanges for users who value security, privacy, and decentralization. Understanding how decentralized crypto exchanges work is essential for anyone looking to invest in cryptocurrencies, as it allows them to choose the exchange that best suits their needs.

When using a decentralized crypto exchange, it is important to be aware of the security risks and to take steps to protect your funds, such as using a secure crypto wallet. It is also important to choose an exchange that operates on a reliable blockchain and has a strong reputation in the community.