Learn what is a market order in crypto and how it works, including the advantages and disadvantages of using market orders in your trading strategy.

The world of cryptocurrency trading can be both exciting and intimidating, with various terms and concepts to learn. One key concept that every crypto trader should understand is the market order. In this article, we’ll explore what is a market order in crypto, how it works, and its advantages and disadvantages.

1. Understanding Cryptocurrency Trading

Before we dive into what is a market order, it’s essential to have a basic understanding of cryptocurrency trading. Crypto trading involves buying, selling, and exchanging digital assets, such as Bitcoin, Ethereum, and other altcoins, with the goal of making a profit. Traders aim to capitalize on price fluctuations in the market, often using different types of orders to execute their trades.

2. Types of Orders in Crypto Trading

There are several types of orders that traders can use when trading cryptocurrencies, each with its own set of characteristics and use cases. Some common order types include:

- Market Order

- Limit Order

- Stop-Loss Order

- Take-Profit Order

Now let’s focus on what is a market order in crypto and how it works.

3. What is a Market Order – Definition

A market order is an instruction to buy or sell a cryptocurrency at the current market price. This type of order is designed to be executed immediately, with the trader prioritizing speed over the exact price at which the trade is executed. Market orders are typically used when a trader wants to enter or exit a position quickly, without waiting for a specific price.

4. How Market Orders Work in Crypto Trading

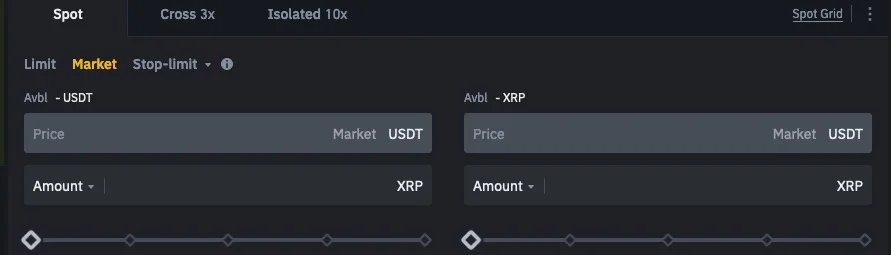

When a trader places a market order, they are essentially telling the exchange to execute the trade as quickly as possible at the best available price. Here’s a step-by-step explanation of how market orders work in crypto trading:

- Placing the Order: The trader submits a market order to buy or sell a specific amount of a cryptocurrency on an exchange platform.

- Order Matching: The exchange’s order matching engine searches the order book for the best available price(s) to fulfill the market order.

- Order Execution: The market order is executed by matching it with one or more limit orders on the opposite side of the order book. The trade may be executed at multiple price levels if there are not enough limit orders at a single price to fulfill the market order.

- Order Completion: Once the market order has been fully executed, the trader receives a confirmation detailing the total amount of cryptocurrency bought or sold and the average price at which the trade was executed.

5. Advantages of Market Orders in Crypto Trading

Market orders offer several advantages for crypto traders, including:

Speed

One of the primary benefits of using a market order is its speed. Since market orders are designed to be executed immediately, they allow traders to enter or exit positions quickly, which can be crucial in fast-moving markets.

Simplicity

Market orders are straightforward and easy to understand, making them a suitable option for beginner traders who may not be familiar with more complex order types.

High Probability of Execution

Due to their nature, market orders have a high probability of being executed, as they do not rely on the market reaching a specific price level. This can be especially beneficial when trading cryptocurrencies with lower liquidity or during periods of high volatility.

6. Disadvantages of Market Orders in Crypto Trading

Despite their advantages, market orders also come with some drawbacks:

Lack of Price Control

Since market orders are executed at the best available price, traders have little control over the exact price at which their trade is executed. This can sometimes result in unfavorable prices, especially during periods of high volatility or when trading cryptocurrencies with lower liquidity.

Slippage

Slippage occurs when the execution price of a market order differs from the expected price due to market fluctuations. This can lead to unexpected losses for traders who use market orders, as they may end up buying at a higher price or selling at a lower price than anticipated.

Potential Impact on Order Book

Large market orders can have a significant impact on the order book, as they may consume multiple limit orders on the opposite side. This can cause the price to move rapidly in the direction of the market order, potentially resulting in unfavorable execution prices.

7. Market Orders vs. Limit Orders

One of the primary alternatives to market orders is limit orders. While market orders prioritize speed and are executed at the best available price, limit orders allow traders to specify the exact price at which they want to buy or sell a cryptocurrency. Limit orders are only executed when the market reaches the specified price or better.

Here’s a comparison of market orders and limit orders:

- Speed: Market orders are executed immediately, while limit orders may remain open until the market reaches the specified price.

- Price Control: Limit orders offer traders more control over the execution price, while market orders can result in unexpected prices due to market fluctuations and slippage.

- Complexity: Market orders are simpler and easier to understand, making them suitable for beginner traders, while limit orders require more experience and understanding of market dynamics.

8. When to Use Market Orders in Crypto Trading

Deciding whether to use a market order or another type of order will depend on your trading strategy, risk tolerance, and market conditions. Here are some scenarios where using a market order may be suitable:

- Entering or Exiting a Position Quickly: If you need to enter or exit a position immediately, a market order can be an appropriate choice, as it prioritizes speed over price.

- Highly Liquid Markets: In highly liquid markets with tight spreads, market orders are less likely to result in significant slippage, making them a viable option for traders who prioritize speed.

- Low Volatility: During periods of low volatility, market orders may be a suitable choice, as price fluctuations are less likely to result in unfavorable execution prices.